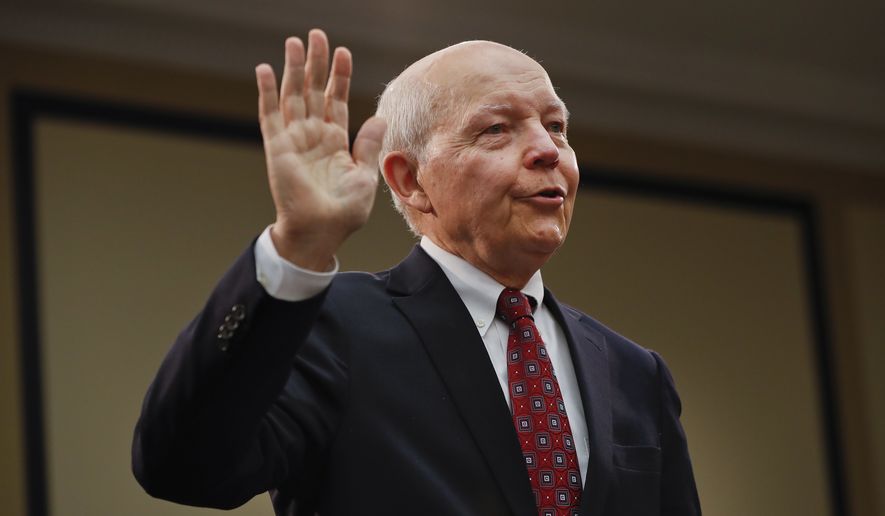

He admitted that the IRS bungled tea party applications and that he gave wrong information to Congress, but Commissioner John Koskinen told lawmakers Wednesday he didn’t mean to mislead anyone and said ousting him from the troubled tax agency would stall the progress he has made in cleaning things up.

“I accept that it is up to you to judge my overall record. But I believe that impeachment would be improper, it would create disincentives for many good people who serve, and it would slow the pace of reform and progress at the IRS,” the commissioner said at a hearing called to set the stage for his possible impeachment.

Mr. Koskinen was appointed to be the troubleshooter after the tea party targeting scandal. But he ran into problems in trying to fend off the congressional probes into the targeting, including overseeing the deletion of backup tapes containing emails sent or received by senior executive Lois G. Lerner — a key figure in the targeting probe.

Mr. Koskinen had assured lawmakers that everything was being preserved and said his staffers couldn’t find any backup tapes.

But inspector general investigators quickly located many of the tapes, though not before more than 400 were erased despite a subpoena for their contents.

“What really makes me mad about this whole sorry episode is that the IRS subpoenas information from taxpayers all the time and if the average taxpayer exercised the same lack of cooperation that the IRS displayed in this matter, that taxpayer would be in a world of trouble,” said Rep. Steve Chabot, Ohio Republican.

Republicans said Mr. Koskinen should have been fired and challenged him to resign as a show of accountability.

But even as he acknowledged bungling the probe and misleading Congress, he said it was unintentional and he won’t quit over “an honest mistake.” Instead, he blamed underlings for giving him bad information.

“If I knew then what I know now, I would’ve testified differently. But at the time, I testified honestly on what I knew and what I had been told,” he said.

He pointed the finger at two people who worked the graveyard shift at an IRS tech facility in Martinsburg, West Virginia, who he said deleted the backup tapes. He said some 50 advisers worked with him on the search for the Lerner emails, leaving him with the mistaken impression that they had done everything they could to recover the messages.

None of those advisers has been punished, and at least one of the two workers on the graveyard shift is still employed by the IRS, the commissioner confirmed.

“We don’t think anybody consciously or purposely did anything to interfere with the investigation,” he said.

That defense is similar to the one that FBI Director James B. Comey mounted on behalf of former Secretary of State Hillary Clinton, whom he cleared of wrongdoing in her handling of classified emails, saying she was too technologically stunted to understand the risks she was taking with top-secret emails.

Mr. Koskinen did say that employees directly implicated in the original tea party targeting no longer work for the IRS. Ms. Lerner, for example, was reassigned and then allowed to retire from government service, collecting her full pension.

Mr. Koskinen seemed to take pride in having defied calls for his ouster, saying Republican members of the House Oversight and Government Reform Committee had posted a target list of 20 government executives who they thought should go.

“They have big pictures and they have big red X’s through 18 of them. So they’ve been successful 90 percent of the time. I’m one of the two that they have not thus far been able to get,” he said.

Democrats, enraged at the hearing, said impeachment was uncalled for and tried to turn the proceedings into an attack on Republican presidential nominee Donald Trump.

Rep. Jerrold Nadler, New York Democrat, read out press reports questioning Mr. Trump’s charitable family foundation expenditures, some of which appeared to be focused on the billionaire businessman himself. Mr. Nadler asked Mr. Koskinen to weigh in on whether that was legal.

Mr. Koskinen said using charitable funds for personal gain was illegal, but declined to opine on the specifics of any case.

Rep. Sander M. Levin of Michigan, the top Democrat on the Joint Committee on Taxation, filed a request Wednesday asking that Mr. Koskinen pursue the case by auditing the Trump Foundation.

“It is important that charitable funds be used for charitable purposes, rather than promote the business ventures of those affiliated with the charity. I therefore request an immediate audit of the Donald J. Trump Foundation,” he wrote.

• Stephen Dinan can be reached at sdinan@washingtontimes.com.

Please read our comment policy before commenting.