Oil prices soared after a coordinated attack hit the heart of Saudi Arabia's oil industry on Saturday, forcing the kingdom to cut its oil output in half.

Brent crude futures, the international benchmark, rose as much as 19.5% to $71.95 per barrel at the open, the biggest jump on record. The contract closed the session up 14.6% at $69.02.

U.S. West Texas Intermediate futures climbed as much as 15.5% to $63.34, the biggest climb since December 2008. The contract settled at $62.9, up $8.05 or 14.8%.

U.S. gasoline futures surged 12.8%, or $0.20, at $1.75 per gallon.

An oil processing facility at Abqaiq and the nearby Khurais oil field was attacked on Saturday, knocking out 5.7 million barrels of daily crude production or 50% of the kingdom's oil output. Saudi Aramco, the national oil company, reportedly aims to restore about a third of its crude output, or 2 million barrels by Monday. However, Bloomberg News reported it could take weeks before Aramco restores the majority of its output at Abqaiq.

Iranian president Hassan Rouhani said Monday the attacks on Aramco were a "reciprocal response" to the aggression against Yemen.

A Saudi-led military coalition said Monday the attack was carried out by "Iranian weapons" and did not originate from Yemen.

"While in the short term the direct physical impact on the market might be limited, this should move the market away from its bearish macroeconomic cycle and raise the risk premium in the market as funds reduce their short positions," said Chris Midgley, global head of analytics, S&P Global Platts.

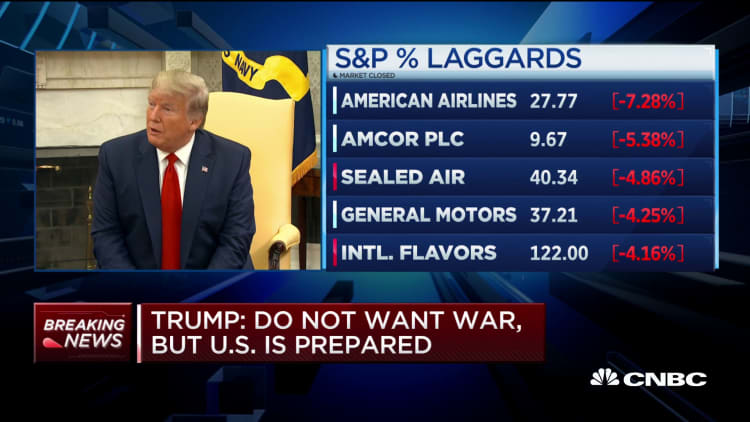

Oil prices came off their highs after President Donald Trump said he was authorizing the release of oil from the Strategic Petroleum Reserve to keep the markets "well-supplied."

Abqaiq is the world's largest oil processing facility and crude oil stabilization plant with a processing capacity of more than 7 million barrels per day. Khurais is the second largest oil field in the country with a capacity to pump around 1.5 million barrels per day. In August, Saudi Arabia produced 9.85 million barrels per day.

Yemen's Houthi rebels claimed responsibility for the attack, saying it was one of their largest attacks ever inside the kingdom. The Houthis have been behind a series of attacks on Saudi pipelines, tankers and other infrastructure in the past few years.

Trump also said there is reason to believe the U.S. knows the culprit and is "locked and loaded," while waiting to get the verification from the kingdom to proceed.

Secretary of State Mike Pompeo blamed Iran for the drone strikes, saying in a tweet Saturday Iran has launched an "unprecedented attack on the world's energy supply."

"If the Iranians have been driven to desperate measures from the loss of crude export revenues, an attack on Saudi capacity seems a likely response," Jason Gammel, energy analyst at Jefferies, said in a note on Sunday. "The risk of wider conflict in the regions, including a Saudi or US response, will likely raise the political risk premium on crude prices by $5-10/bbl."

Goldman Sachs said an extended oil outage could push Brent crude prices north of $75 per barrel as the attack disrupts one of the globe's largest energy supply chains.

The latest attack came as Saudi Arabia moves forward to take Saudi Aramco public in a major shakeup of the kingdom's energy sector. Saudi Aramco President and CEO Amin Nasser said Saturday nobody was hurt in the attacks and work is underway to restore production. Aramco did not immediately respond to CNBC's request for comment on Monday.

WATCH: Saudi oil facilities damaged at around 17 points of impact